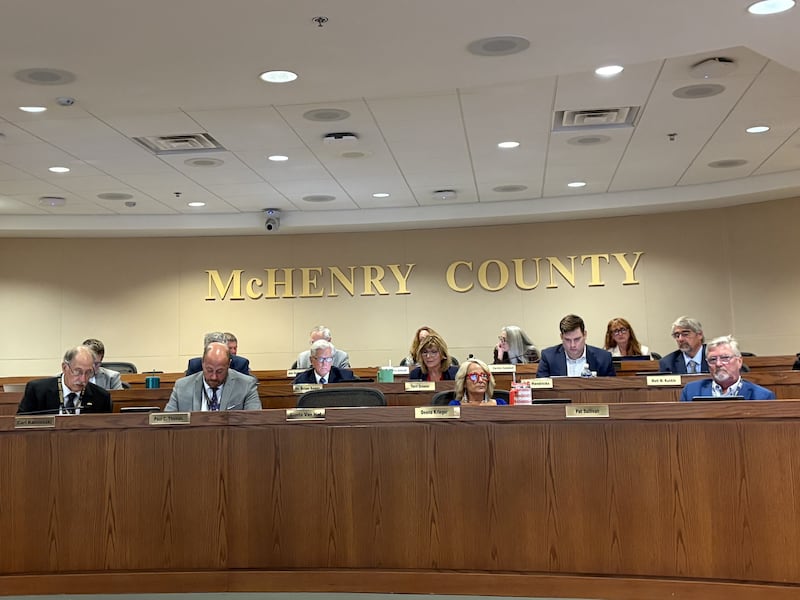

The McHenry County Board has voted to raise its property tax levy by the inflation-tied limit allowed under the tax cap.

The board needed multiple votes on the levy, which also allows the county to capture new property growth, before it narrowly passed, 9-8.

[ Opponents of solar farm near Johnsburg pack county board meeting ]

Board members Joe Gottemoller, Terri Greeno, Carl Kamienski, Deena Krieger, Mike Shorten, Larry Smith, Pat Sullivan, Paul Thomas and Tracie Von Bergen voted in favor of the tax levy that ultimately passed.

Board members Carolyn Campbell, John Collins, Eric Hendricks, Jim Kearns, Matt Kunkle, Brian Sager, Michael Skala and Gloria Van Hof voted against the levy. Board member Pamela Althoff was absent.

Some of the board members who voted against the CPI and new growth had voted in favor of the so-called lookback option, which would have allowed the county to raise its levy even more, reverting to its level before a 2024 sales tax increase referendum that was billed as coming with a property tax levy reduction.

The lookback option was also voted on multiple times Tuesday evening and never got enough votes to pass.

Greeno said the property tax cap law exists for a reason, and the lookback was exactly what the board told people they wouldn’t do.

Hendricks said supporting the lookback option is an “absolute betrayal to our voters” and “it’s an absolute joke that we’re doing this.” He said it was indefensible to support the lookback.

The board was required to approve something Tuesday evening ahead of the new fiscal year beginning Dec. 1.

Gottemoller proposed the inflationary increase allowed under the tax cap, saying that option would raise the tax base by the consumer-price index or CPI, a measure of inflation that this year is 2.9%, and new growth.

McHenry County Board Chair Mike Buehler said the county has maintained good fiscal stewardship over the years, despite inflation and despite unfunded mandates from the state legislature such as the SAFE-T Act, which he said has resulted in $1 million more in annual costs to the county. Buehler also cited the loss of $18 million from a contract the county had with the federal Immigration and Customs Enforcement agency to house immigrant detainees at the McHenry County jail, which the county was forced to end after a state ban was passed in 2021.

“There comes a time when property tax relief comes at a cost for fiscal stability of the county,” Buehler said, adding there could be unknowns down the road and that tax relief could affect things like the county’s ability to fully fund law enforcement.

Buehler encouraged his colleagues to vote for the lookback and said it was the best path to keeping taxes low in the coming years.

Collins also backed the lookback, saying the levy vote “was about responsibility” and that the lookback is a tool to ensure the county stays on “firm financial footing.” Collins said if the county doesn’t act, “we risk leaving this county structurally unstable for years to come.”

Collins took issue with Hendricks’ comments about “lying to people” about the sales tax referendum, with Collins noting some current members, such as himself, were not on the board when that measure was placed on the ballot.

“That broad kind of a statement [is] not necessary,” Collins said. He added it’s easy to campaign on the promise of never raising property taxes but “governing is harder. Governing requires courage.”

Kearns said he has always before supported a flat levy or decrease. He said the board kept its word to remove the mental health board share of the levy last year. But, without the lookback, the county’s finances won’t sustainable in his view.

“Cuts have to be sustainable. We are no longer sustainable,” Kearns said, also citing actions over which the board had no control, like the SAFE-T Act and the end of the ICE contract.

Kearns said the county would need to continue cutting, even if the lookback passed, but he recognized he might pay for it at the polls one day for supporting it.

The county’s levy that was approved Tuesday is $67.7 million.

The county board reviewed a few options in a very tight budget year, with the county having to close a budget gap that at one point was estimated to be as high as $3.7 million. That figure was since decreased, and county officials said touted the budget that was approved along with the levy as being balanced.

The lookback option was the one put up for public review last month. That option would have reset the property tax levy to its fiscal 2024 level of $73.8 million, where it was before voters approved the sales tax increase to fund the Mental Health Board.

However, officials had also proposed a $4.2 million abatement with the lookback option, meaning taxpayers would not have be charged for that.

Because the lookback option was rejected, no tax abatement is planned.

Last year’s levy was around $65 million, after the board took off the $11 million that funded the mental health board but also opted to take some, but not all, of the inflationary increase allowed by law.

Next year’s budget cycle is also shaping up to be tight, with the board having to deal with the end of COVID-19 relief dollars, among other stressors. The county board also voted in September to raise the salaries of many countywide elected officials and some of those raises take effect late next year, when the county’s fiscal 2027 budget kicks in and new terms for those offices begin.

McHenry County Treasurer Donna Kurtz cited the county’s financial challenges last week when she argued for a higher levy.

Kurtz warned against dipping into fund balances for recurring expenses, saying that could lead to decreased investment income, risk lawsuits for failure to provide services and make the county vulnerable if faced with unexpected costs like disasters or a recession.

County officials made the case that the county has left money on the table and the levy has not kept up with inflation, which has amounted to cuts. County officials have said the levy has been lowered over the past 10 fiscal years, saving taxpayers around $128.2 million in taxes since fiscal 2017.

The county’s levy was about $79.4 million in fiscal 2017, according to county records.

County officials said Wednesday a homeowner whose home is worth $325,000 would pay an additional roughly $20 in the county share of their tax bill.