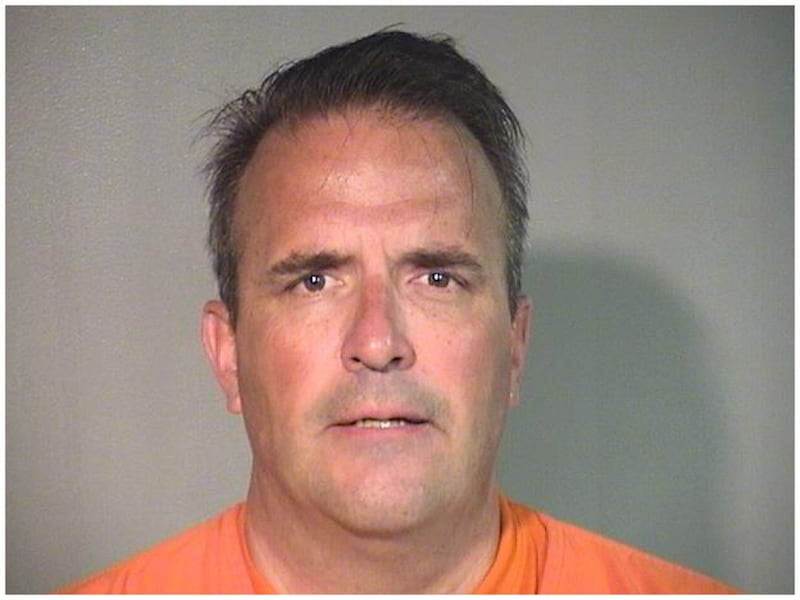

A Lake in the Hills businessman was denied in a request to seal his conviction for defrauding the state of more than $3 million in sales tax.

Kenneth Kilberger, 56, pleaded guilty in 2022 to tax evasion and was sentenced to four years in prison. In pleading guilty, he admitted to hiding $42 million in income from the state, earned from a group of Denny’s restaurants he had owned and operated.

Although some convictions can be expunged or sealed after certain requirements are met, the decision ultimately is up to the courts, Judge Tiffany Davis said. Those requirements include waiting until three years after completion of someone’s last sentence. Under this criteria, Kilberger won’t be eligible until after March 19, 2026, Davis said.

In her ruling, Davis said the court is going to use its discretion and deny the request based on not meeting the time frame. She also said the court finds “the public’s interest in retaining your criminal records is greater than your interest in sealing your records” at this time. He can petition the courts again after the eligibility date, she said.

Kilberger’s attorney, William Sullivan, argued that Kilberger already is eligible because the three-year time frame does not apply to him and he has met other requirements, including earning automotive and paralegal certificates while in prison.

However, John Greenwood, assistant attorney general with Illinois Attorney General’s Office, said in court Wednesday that the state objects to sealing the conviction. He said those certificates do not work in Kilberger’s case because he already has a bachelor’s degree and is a Certified Public Accountant.

Greenwood said Kilberger is a “sophisticated businessman” who committed a “sophisticated crime” and once owned “several Denny’s.” He currently is helping to manage “several” Denny’s and is not currently working as an auto mechanic or paralegal.

“He is not who the statute was intended for,” Greenwood said.

Sullivan said Kilberger knew and admitted what he did was wrong and accepted responsibility. He went to prison, where he “worked every single day he was there ... multiple jobs.”

When first questioned by authorities, he answered with “absolute and complete disclosure” and the Internal Revenue Service allowed him to prepare and complete amended tax returns and file electronically, Sullivan said.

Kilberger has since paid more than $25,000 in court fines and fees and more than $3 million to the Illinois Department of Revenue, records show.

Sullivan said his client “paid back every dime” plus penalties and interest. “He tried to put things right.”

Since being convicted, Kilberger lost equity in all of his Denny’s locations and no longer owns any restaurants. He works for a friend who owns dozens of Denny’s restaurants, Sullivan said. Denny’s executives did not want to throw him out of the franchise but had to because it is a publicly held company, Sullivan said.

In an affidavit in Kilberger’s court file, he said he had owned about 30 Denny’s locations. He lost $8 million to $10 million in equity interest he “had built up over 25 years. Because I had reinvested the profits, everything I had worked to accumulate was lost.” He could no longer be part of the franchise because “Denny’s requires that its franchisees be free of felony convictions,” he wrote in the affidavit.

Kilberger “lost everything” and is “trying to create a new life” for his wife and family. There is nothing he can do “to undo the harm he’s done to his family,” Sullivan said. “There is no reason to re-punish.”

The attorney said with the conviction readily accessible, Kilberger is “going to get turned down” any time he applies for a job without a chance to “get his foot in the door,” and the conviction also keeps him from advancing in his current job.

Kilberger is not working commercially as a CPA but does some work for friends and family, Sullivan said.

As a licensed CPA since 1995, Kilberger still faces discipline by the Illinois Department of Financial and Professional Regulation Division of Professional Regulation, according to the complaint filed by the agency and submitted with the objection in McHenry County courts by the Illinois Attorney General’s office.

According to the department of professional regulations complaint, Kilberger’s “criminal felony conviction constitutes engaging in dishonorable, unethical, or unprofessional conduct of a character likely to deceive, defraud, or harm the public.” He could lose his license and be fined $10,000, according to the complaint.

In the response objecting to sealing Kilberger’s conviction, Illinois Attorney General Kwame Raoul’s office argued in part that sealing Kilberger’s conviction “will have the effect of thwarting any disciplinary action or complaint against his CPA license undertaken by the Illinois Department of Financial and Professional Regulation.”

Kilberger is scheduled for a preliminary hearing regarding his CPA license Sept. 15, according to the professional regulation website.

Among several factors the McHenry County judge said she considered in denying Kilberger’s motion is that keeping the conviction in the open might “deter others” from committing the same crime.

The attorney general accused Kilberger of evading taxes on sales from 11 Denny’s restaurants from 2016 to 2020. At the time, he was president and CEO of PFC Classic Dining Restaurant Group of Algonquin, which owns 29 Denny’s locations in Illinois and Indiana and one Ruby Tuesday in Wisconsin, according to the company’s website. Kilberger’s Linkedin still lists him as a business owner at PFC Classic Dining Original in Lake in the Hills.