Although shoppers won’t notice any difference in the checkout line, the Kankakee City Council OK’d a 1% local grocery tax.

The 1% tax generates about $1.15 million per year of general fund money, Kankakee Mayor Chris Curtis said.

Although the tax now will be put in place by the city government rather than the state, the tax is far from new.

Municipal governments were given the option to institute their own 1% tax – formally known as the municipal grocery occupation tax – as Gov. JB Pritzker signed legislation last August that eliminated the 1% tax, effective Jan. 1, 2026.

Municipalities were given the option to keep the tax or simply let it disappear at the conclusion of 2025.

Numerous Kankakee County municipalities have adopted legislation to reinstate the tax locally.

However, the vast majority of municipalities – more than 95% of local governmental boards across the state, Curtis noted – have approved laws to keep the fee in place.

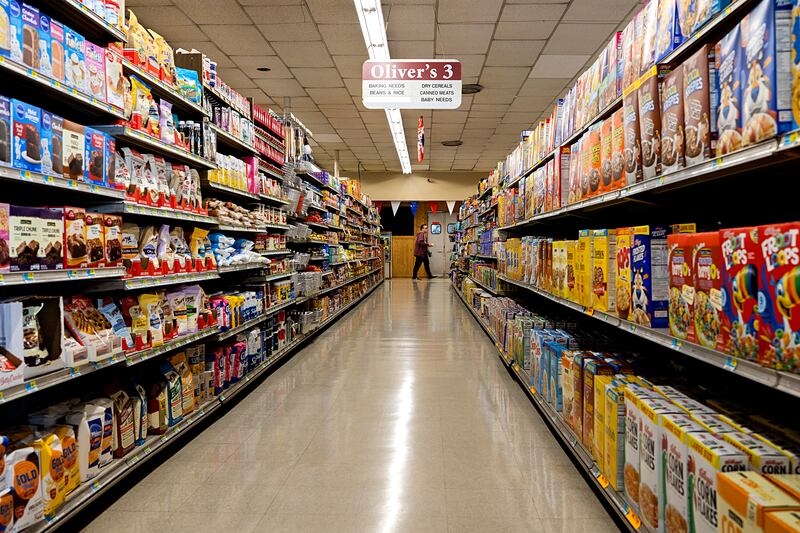

In simple terms, the 1% tax equates to an additional $2 on a $200 grocery store bill.

The Illinois Department of Revenue requires all municipalities instituting this tax to submit the paperwork to the state no later than Oct. 1.

The city’s ordinance was presented to council members June 16. The ordinance’s second reading was unanimously approved by the council.

The 1% tax does not apply to vehicle nor medication sales.

Although this tax may sound shocking, Curtis said it does not change anything taking place throughout the city. The only thing changing is the tax is put in place by the municipality – in this case, Kankakee – rather than Illinois.

If the city did not enact this ordinance, the tax would have ended at the conclusion of 2025.

Kankakee maintains an 8.25% sales tax, having enacted a 2-percentage-point increase in 2018. The 2-percentage-point increase is earmarked directly for police and fire pension funds.

From the onset of the changing dynamic of the sales tax, Curtis said that Kankakee would have its own tax created.

:quality(70)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/shawmedia/dfb924db-1795-46ea-afb4-ba3c95e55c46.jpg)