Streator shoppers will continue paying a 1% sales tax on most grocery items starting next year, after Streator City Council voted on Wednesday night to keep the city’s existing share of the tax after the state repeals its portion.

Notably, this is not a new tax, but a continuation of the 1% local sales tax the city has already been collecting on grocery items. Without council action, the local tax would have automatically ended along with the state’s share.

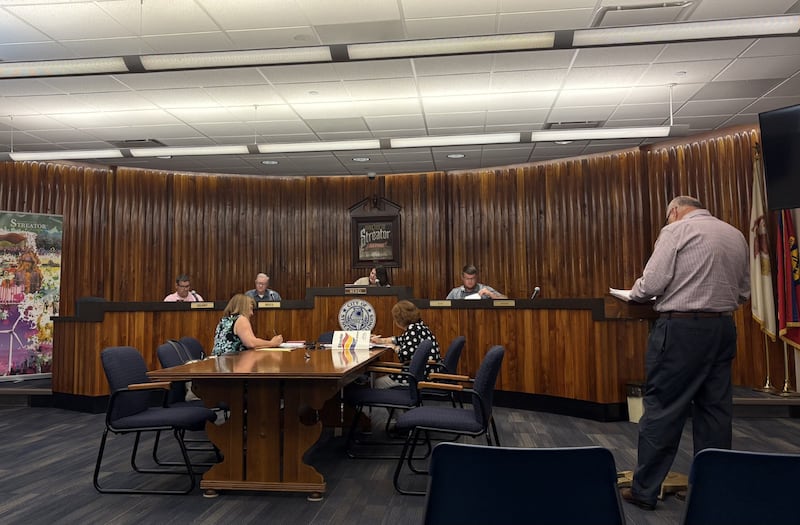

The council discussed the issue earlier this month during its Committee of the Whole meeting, taking a look at how other nearby communities were dealing with it.

City officials said the ordinance allows Streator to continue collecting an existing revenue stream without increasing property taxes.

“The state decided to eliminate their 1% grocery tax, and while it might seem like a good PR move to decrease taxes, the responsibility just shifted to municipalities and counties,” Mayor Tara Bedei said. “No one enjoys taxing residents, but we can’t afford to lose between $200,000 and $300,000 from our general fund.”

“We’re not increasing the percentage - we’re simply trying to maintain revenue, not gain more.”

The tax applies to most grocery items but excludes alcoholic beverages, candy, soft drinks and prepared foods intended for immediate consumption.

It also applies to certain service providers who transfer groceries as part of their services.

According to the Illinois Department of Revenue, food related sales, including groceries, bakeries, candy stores and markets, brought in roughly $590,000 in sales tax revenue for Streator in 2024.

According to city documents, financial consultant Steve Litko estimated the city’s 1% share on grocery items alone accounts for $200,000 to $300,000 annually.